Understanding Ethereum Restaking: A Potential Narrative for 2024

|

| Ethereum restaking, Ethereum staking, EigenLayer, liquid restaking. |

Ethereum restaking refers to reusing staked ETH to earn rewards from other protocols through staking. This concept allows staked tokens to help secure and validate multiple protocols simultaneously. In this article, we delve into the nuances of Ethereum restaking, its mechanisms, types, benefits, and associated risks, highlighting why it could be a significant trend in 2024.

What is Ethereum Restaking?

Ethereum restaking enables users to stake the same ETH on both the Ethereum network and other protocols concurrently, thereby securing multiple networks at once. By leveraging validators and staked tokens on Ethereum, restaking protocols can utilize Ethereum’s robust security and trust systems, minimizing the risks of attacks or failures.

Key Features and Benefits

1. Enhanced Security: Restaking protocols benefit from Ethereum’s established security infrastructure, reducing vulnerability to attacks.

2. Maximized Returns: Users can earn multiple streams of rewards by staking the same ETH across different protocols.

3. Increased Liquidity: Liquid staking derivatives (LSDs) and liquid restaking tokens (LRTs) provide liquidity and flexibility, enabling users to engage in financial activities without un-staking their assets.

Major Players in Ethereum Restaking

EigenLayer: Launched on mainnet in June 2023, EigenLayer is the largest Ethereum restaking platform with a total value locked (TVL) of $15.2 billion, making it the second-largest DeFi platform after Lido. EigenLayer introduces Ethereum liquid restaking tokens (LRTs), creating a new sub-sector known as LRT finance (LRTfi).

|

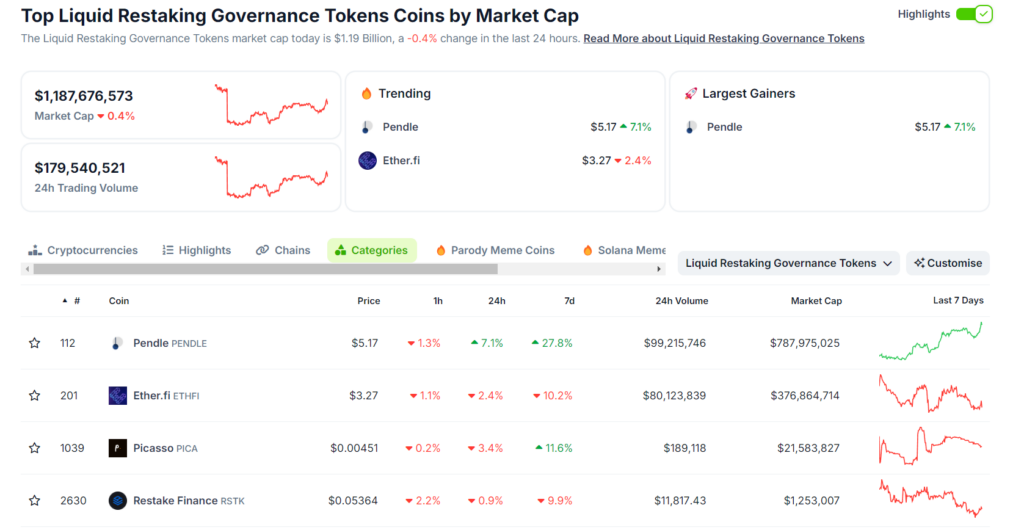

| Gambar: Daftar token governance platform LRTfi. Sumber: CoinGecko. |

Types of Ethereum Restaking

1. Native Restaking: Requires users to operate their own validators and adopt additional node software specific to the restaking network. This type of restaking is suitable for technically proficient users.

2. Liquid Restaking: Utilizes liquid staking tokens (LSTs) such as Lido’s stETH. Users deposit their LSTs into liquid restaking platforms like Puffer, Ether.Fi, and Renzo, which handle the complexities of managing restaking services.

Mechanisms of Ethereum Restaking

Native Restaking

- Validator Operation: Users run their own validator nodes, staking native assets to secure the network.

- Smart Contracts Management: Manages staked assets, ensuring they are secure and efficiently handled.

- Additional Node Software: Validators integrate specific software required for the restaking network.

- Terms Acceptance: Validators must agree to additional slashing conditions imposed by restaking protocols.

- Security Enhancement: Validates multiple protocols, enhancing security across networks.

- Additional Rewards: Earns extra rewards based on participation and the number of protocols secured.

Liquid Restaking

- Staking with Validator: Users stake assets with a validator through liquid staking protocols, receiving LSTs in return.

- LST Utilization: LSTs represent staked assets, retaining liquidity and enabling further usage in restaking protocols.

- LST Staking: Users stake LSTs in liquid restaking platforms, contributing to multiple network securities.

- Exploring AVS: Users can explore Actively Validated Services (AVS) in platforms like EigenLayer for additional yield.

- Reward Accumulation: Earns extra rewards by securing multiple protocols, distributed based on participation.

- Accepting Slashing Terms: Users must adhere to slashing conditions to ensure network security.

Advantages of Ethereum Restaking

- Enhanced Flexibility: Validators can use staked assets for various financial activities, maintaining liquidity and earning additional rewards.

- Increased Yield Potential: By securing multiple protocols, validators generate multiple revenue streams.

- Scalable Security: Protoc protocols can flexibly scale security based on network demand, offering a cost-effective approach to network security.

- Boosted Security for New Protocols: Emerging protocols gain access to a large pool of validators, significantly enhancing their security.

Risks of Ethereum Restaking

1. Centralization Risk: Validators offering higher Annual Percentage Yields (APY) may attract more delegates, potentially leading to stake centralization and loss of neutrality.

2. Slashing Risks: Restaking introduces additional slashing conditions, increasing the risk of significant losses if these conditions are violated.

3. Smart Contract Vulnerabilities: Smart contracts used in restaking protocols may contain bugs or vulnerabilities, leading to financial losses or exploits.

4. Third-Party Risks: Validators must trust third-party operators to manage staked assets. Failure to comply with network conditions could result in slashing penalties.

Conclusion

Ethereum restaking addresses significant limitations of traditional staking models, offering increased yield potential for validators and enhancing network security through resource aggregation. As restaking evolves, it is likely to play a crucial role in the future of blockchain security and decentralized finance (DeFi).

However, it is essential for validators, developers, and investors to thoroughly assess the risks and conduct due diligence before participating in restaking protocols. Managing these risks effectively will ensure the sustainable growth and adoption of Ethereum restaking in the years to come.

0 Response to "Understanding Ethereum Restaking: A Potential Narrative for 2024"

Post a Comment